Radford University

Radford News

Latest News

-

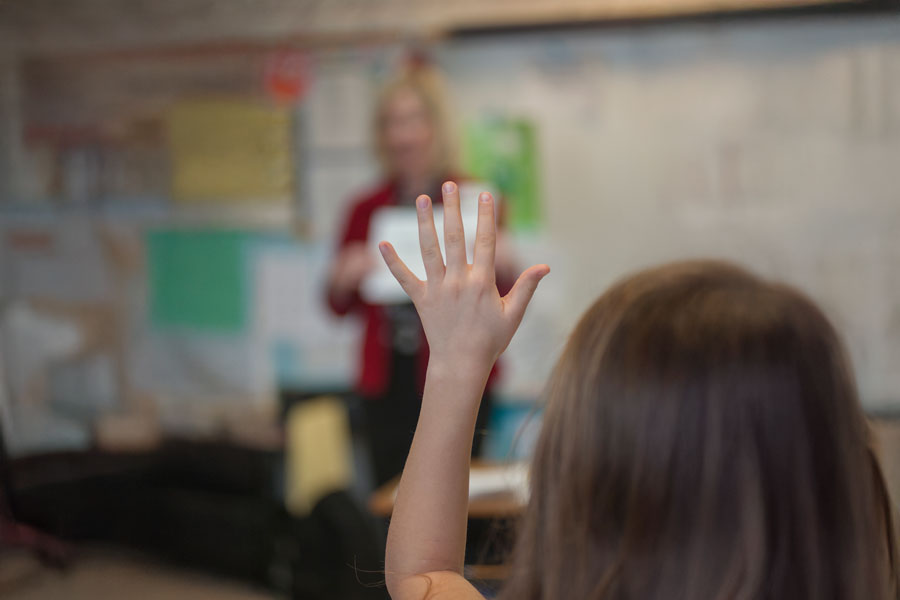

Radford University helps address Virginia’s teacher shortage through targeted licensure support

February 20, 2026

Radford University launched a targeted scholarship initiative to support provisionally licensed teachers in completing their licensure requirements.

-

Advocacy Day connects students with Virginia lawmakers

February 20, 2026

Radford University students spent Feb. 3-4 at the Capitol in Richmond, Virginia, for the university’s annual Advocacy Day.

-

Highlanders in the News: Week of Feb. 16, 2026

February 20, 2026

Matthew Bagley ’15 – aka musician Alexander Mack – enjoys a brush with Grammy glory; veteran seafarer Erica Custis ’99 gets props from Marine Log magazine; and journalist Marty Smith ’98 reflects on his past with the Post.

-

Jobs for Virginia Graduates event gives college careers some ignition

February 19, 2026

Held Feb. 12 at Kyle Hall, the statewide JVG Ignite competition – designed to demonstrate innovation, knowledge and preparation – saw five students receive $1,000 each in Radford University scholarship funds.

-

Radford University Board of Visitors will consider tuition and mandatory fees for the 2025-2026 academic year at its next quarterly meeting.

-

Highlander Highlights: Week of Feb. 9, 2026

February 13, 2026

Highlander Highlights shares with readers some of the extraordinary research and accomplishments happening on and off campus through the tireless work and curiosity of our students, staff, alumni and faculty.

-

Highlanders in the News: Week of Feb. 2, 2026

February 6, 2026

Radio IQ drops in on an arresting art installation at the Radford University Art Museum; Courtney Ballantine ’00 is Georgetown University Police Department’s new chief; and on the eve of her debut novel, Cassie Miller ’07 is named one of Publishers Weekly’s ‘Writers to Watch.’

-

Shadow Day 2026 – “Highlanders helping Highlanders”

February 3, 2026

Late last month, the Davis College of Business and Economics held its second Shadow Day, in which about 100 students met and spoke with 20 successful Radford graduates, through 40 separate sessions across the morning and afternoon of Jan. 23.