Radford University

Radford News

Latest News

-

Highlander Highlights: Week of Jan. 26, 2026

January 30, 2026

Highlander Highlights shares with readers some of the extraordinary accomplishments happening on and off campus through the tireless work and curiosity of our students, faculty, staff and alumni.

-

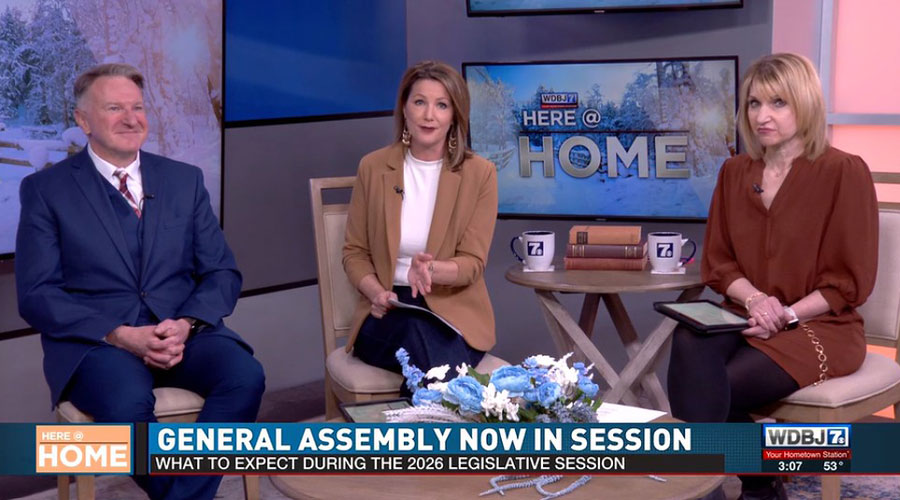

Highlanders in the News: Week of Jan. 19, 2026

January 23, 2026

The NCAA recognizes the efforts of Charlene Curtis ’76 and Alex Guerra ’11; Radford Department of Political Science Chair Chapman Rackaway previews Virginia’s 2026 General Assembly for WDBJ-7; and freshman Connor Worthington donates time to a worthy cause in his hometown.

-

Radford University officially launches six-year strategic plan

January 23, 2026

After months of planning, Radford University’s new strategic plan is in place.

-

More than a half-dozen Radford business students were recent recipients of individual awards totaling $23,500, and the local chapter of their academic society netted an additional $1,000, money that will help them travel to events in their field.

-

Budding sportswriter already has substantial experience covering collegiate sports for a variety of media outlets.

-

Criminal justice student researches police retention

January 16, 2026

“Radford is a fantastic school to do research,” Gary said. “There are so many opportunities here, and you feel very, very, very supported.”

-

Highlander Highlights: Week of Jan. 12, 2026

January 16, 2026

Highlander Highlights shares with readers some of the extraordinary research and accomplishments happening on and off campus through the tireless work and curiosity of our students, staff and faculty.

-

Geospatial science major finds her place through Honors College, research and internships

January 15, 2026

Kayla Fields is gaining hands-on research experience examining water quality in the Chesapeake Bay.